Are your investments contributing to deforestation, the global climate crisis or the military industrial complex?

Utilize the resources on this page to learn how to make essential changes that empower you to align your investments with your values!

Empower Your Impact: Redirect Your Investments for a Sustainable Future!

Are you aware of the power your investments and insurance choices hold? It's time to harness that power to drive positive change. Many traditional investment paths may inadvertently support industries that contribute to climate change, deforestation, and other global challenges. But you have the ability to make a difference! By choosing to invest in sustainable and ethical options, you can help reduce reliance on fossil fuels, protect our forests, and promote peace over conflict. Your financial choices can support innovation and sustainability, leading to a healthier planet and a brighter future for all. Let's take action together and ensure our dollars are building a world we can be proud of.

Banks, Investment Tools and Insurance

Credit Unions are an Excellent Alternative to Commercial Banks!

Credit unions are member-owned financial cooperatives that provide traditional banking services. They operate with the primary goal of serving their members rather than maximizing profits. Here's how they generally work:

Membership: To join a credit union, you typically need to meet certain eligibility requirements, such as living in a specific area, working for a certain employer, or being part of an organization. Once you become a member, you're also a part-owner of the credit union.

Not-for-Profit: Unlike banks, credit unions are not-for-profit institutions. This means they return their profits to members in the form of lower fees, better interest rates, and dividends.

Products and Services: Credit unions offer a wide range of financial products and services, including savings accounts, checking accounts, loans, credit cards, and mortgages. They often have competitive rates compared to traditional banks.

Governance: Credit unions are governed by a board of directors elected by and from the membership. This democratic structure means that members have a say in how the credit union is run.

Community Focus: Credit unions often focus on serving their local communities and may provide financial education and support local projects.

Insured Deposits: In the United States, deposits in credit unions are insured by the National Credit Union Administration (NCUA), similar to how the Federal Deposit Insurance Corporation (FDIC) insures bank deposits.

Overall, credit unions are a great option for individuals looking for personalized service and a community-focused approach to banking.

Insurance and the Role it Plays in Global Climate Change

Insurance companies are pivotal in the climate crisis, frequently increasing rates and denying coverage to consumers in regions most impacted by climate change. Paradoxically, they also underwrite policies and insure industrial and commercial fossil fuel mining operations, including oil, gas, and coal; industries that significantly contribute to the crisis. This situation prompts crucial questions: Why are families shouldering the financial burden of these decisions? Why are we being affected by the lack of responsible leadership from insurance companies?

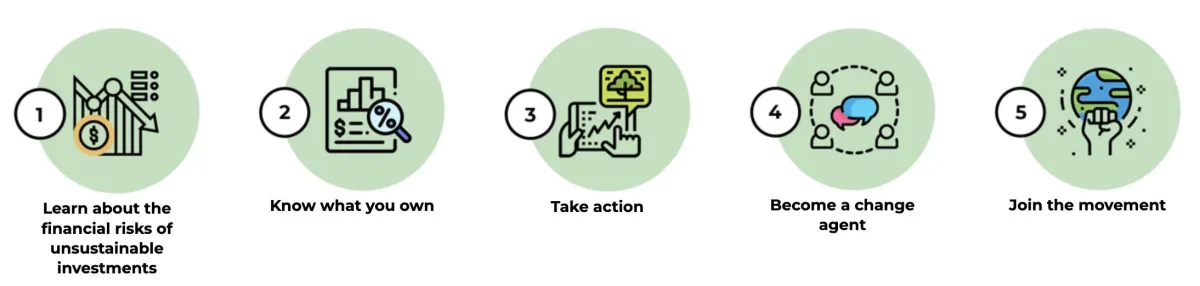

FIVE STEPS TO A SUSTAINABLE RETIREMENT PLAN

Investing in unsustainable options can jeopardize the security of your 401(K).

Your retirement plan may be harming people and the environment.

Know what stocks, mutual funds and other investments that you own.

TAKE ACTION to protect people and the environment.

If your employer is not willing to add sustainable options to your retirement plan, become a change agent!

Join the Movement!

Investments: Is Your 401K Contributing to the Climate Crisis?

To drive significant changes in sustainability and climate mitigation, we must radically transform how we allocate our finances, ensuring our investments align with our values. If you're interested in accessing tools to help you identify where your investments stand, click "Learn More" below.

FUELING THE CLIMATE CRISIS CREATES FINANCIAL RISK

High Stakes

Since the Paris Agreement, major global banks have financed the fossil fuel industry with trillions of dollars.

By maintaining support for high-carbon companies and projects, financial institutions are intensifying the climate crisis, hindering the shift to a clean energy economy, and introducing significant portfolio risks for investors.

Climate change poses financial risks. Investors need to be informed about which companies in their portfolios are contributing to these risks.